Diversity is strength (All your baseload are belong to us)

How will generation meet future basedload?

Collectively, utilities and investors pick a diversified mix of assets to meet demand. No single asset has to shoulder the problem, instead it falls on the aggregate. If the portfolio as a whole is required to address the issue, why should we overpay for the option to have every individual asset switched on at any time?

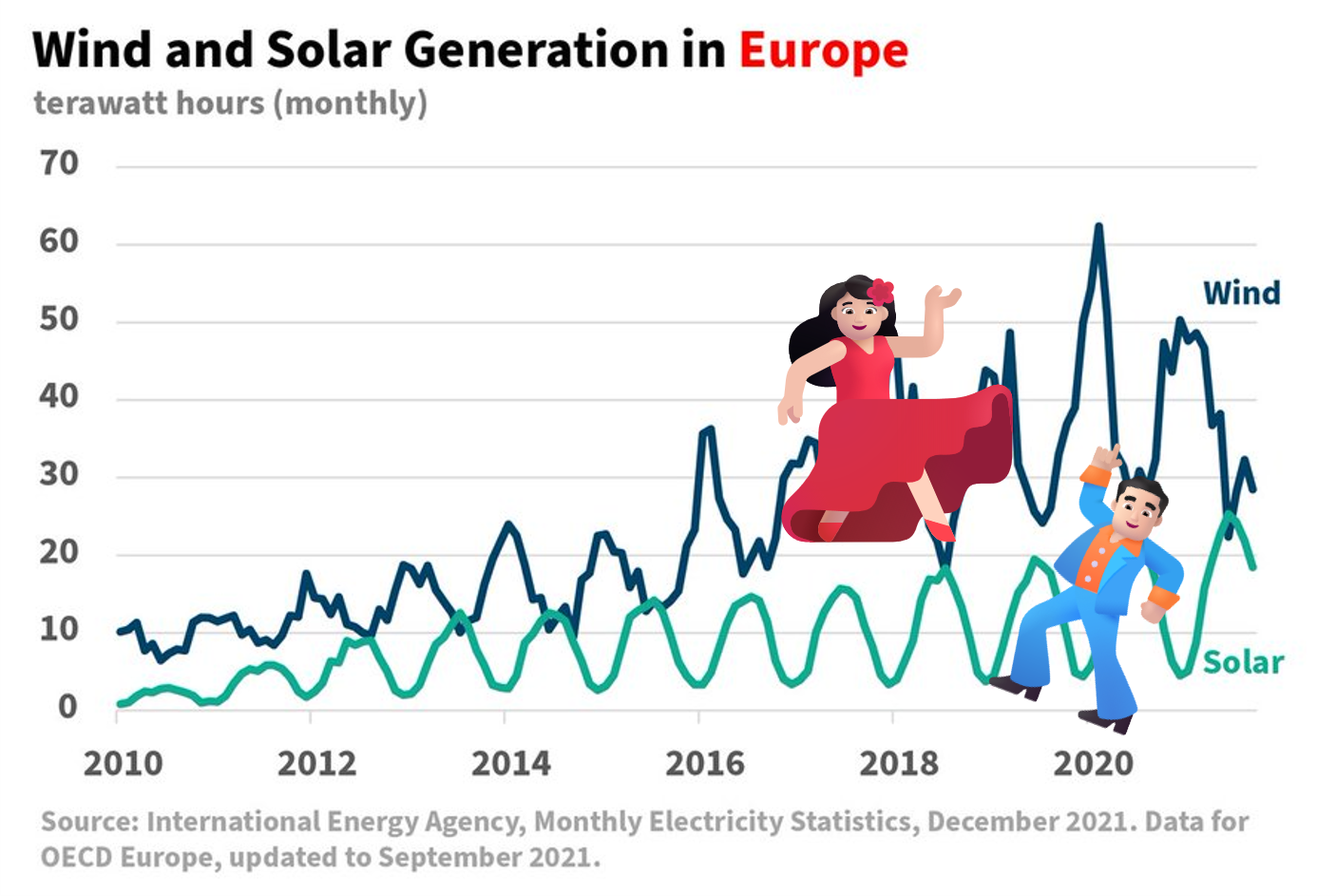

While a single technology at a specific location is quite intermittent, a portfolio of technologies across interconnected regions is more diversified and predictable. Let’s simplify such a portfolio to just wind and solar (together often seen as the backbone of a future energy system). Wind and solar are:

somewhat anticorrelated day/night,

highly anticorrelated summer/winter, and

decreasingly correlated with distance.

Based on these properties, a portfolio can meet a majority of demand with reasonable reliability year-round.

Flex on ‘em

Some dispatchability is still needed in any system. Historically hydro, flexible gas and coal balanced massive coal blocks and nuclear. More hydro (dams and pumped storage) is an obvious contender for this role in the future, but batteries are the most scalable solution as they are independent of geography and are scaling at breakneck speed.

But this is not your father’s load either, as the basedload comes with built in flexibility. Simple price signals would incentivise shifts to heating/cooling, data centre calculations, or shitcoin mining.

As long as we produce enough energy in a 24-hour window, this flexibility enables supply and demand to meet around the clock. In spring 2024, numerous markets in Europe hit zero or lower residual loads during day times or like Germany full days. By 2030, we’ll be swimming in renewable energy from spring to autumn.

Large dispatchable generators will struggle to remain profitable, especially nuclear with its heavy reliance on running flat out (partly for technical/operational reasons but, more importantly, for economic ones). Large power plants have huge upfront costs to cover by producing many MWhs, and are designed to run practically 24/7. However, as summer is pretty much covered by solar and storage, it is not viable for these plants to just run for a few months during winter nights. Even large fossil plants are losing out to small peaking power plants and to batteries who are eating everybody’s lunch.

Tail risk still needs considering in this portfolio – the Dunkelflaute scare

Every portfolio can crash in extreme circumstances. In 2021 alone, we saw gas plants freeze during winter storm Uri in Texas, as well as the European energy crisis, where Russian gas supplies were cut and nearly half of all French nuclear power plants were offline. In a renewables dominated system, the equivalent scenario would be a prolonged period of low temperatures combined with low wind speeds and low solar irradiation – the cold Dunkelflaute (poetic German for dark doldrum).

Now what can we do to minimise that risk? Overbuilding renewable capacity is an option. However, interconnection between areas with uncorrelated generation helps drastically lessen this anyway.

Dunkelflaute is most hotly debated in Germany, where ideologies around renewables, fossil fuels and nuclear clash the hardest. Already in 2018 the German weather service highlighted that a simplified mix of wind and solar across Europe can meet our needs at almost all times.

“Number of 48-hour windows with low wind and solar resources”

Nevertheless, we will need some dispatchable sources with high storage capacity. Molecules will probably take this role. Be it hydrogen and its derivatives or Carbon Capture and Storage (CCS) to enable firing (e-)methane or, in emergencies, even straight up unabated fossil sources.

A simple market-based approach would probably run into failure here, as such costs are poorly priced or even simply ignored. Governments need to play a huge role to ensure adequate backup via a capacity market/auction, where a payment is made to keep MWs on standby to produce MWhs when needed. Consider this cost as an insurance premium or a call option you rely upon when everything around you crashes.

Putting it all together

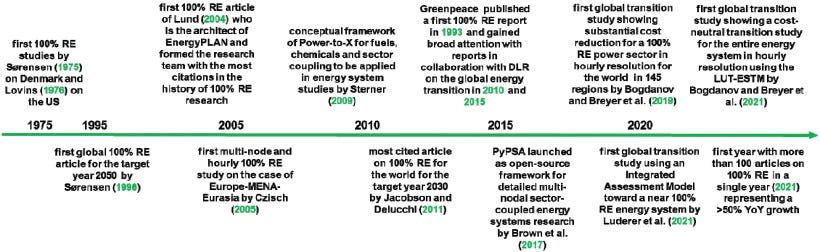

Research continues on (close to) 100% renewables systems and we urge you to check this meta study if you want to dig into the details.

If you want a much simpler regional example, check out David Osmond’s weekly simulations for Australia.

We can confidently say such systems are technically feasible. While the level of total costs ranges widely, the minimum cost system generally is a renewables dominated one. Most of this research is accessible only via an expensive subscription, so you should check high level press releases / blogs such as from BloombergNEF and follow its New Energy Outlooks.

Ultimately, the demand side will add more flex and roof top solar, so you better focus on providing generation capacity that offers valuable MWhs when needed, invest in more grid (and maybe pipes) to transport energy across locations, invest in storage to shift energy over time, or provide the insurance and collect the premium.

The low residual demand for additional energy in tail-events, such as a prolonged continent-wide cold Dunkelflaute that is left by basedload + renewables, is minimal.

Probably much ado about nothing.