When the premiums stop, run

Why insurers’ decisions are a leading indicator of climate collapse

Everyone loves to hate insurers

They take your money, deny your claim and then post record profits. But in the climate crisis, they quietly hold more power than you think.

Insurance started out simply. Money went into a pot, if your ship sank, the pot bailed you out. Basic risk sharing. Fast-forward to now and insurance has become the lubricant of modern capitalism. No insurance, no finance. No finance, no projects. That means no oil, no LNG terminals, no pipelines. This also means no wind and solar farms.

So what happens when the climate crisis makes risk uninsurable?

Take Florida and California for example. Wildfires, hurricanes, floods are becoming too frequent, too costly and too unpredictable. Nobody wants to lose money insuring homes that are virtually guaranteed to burn or drown. Homeowners are stranded. States step in, or people roll the dice uninsured. The UN warned years ago climate change could make entire regions “uninsurable.” That future is now.

Got cover?

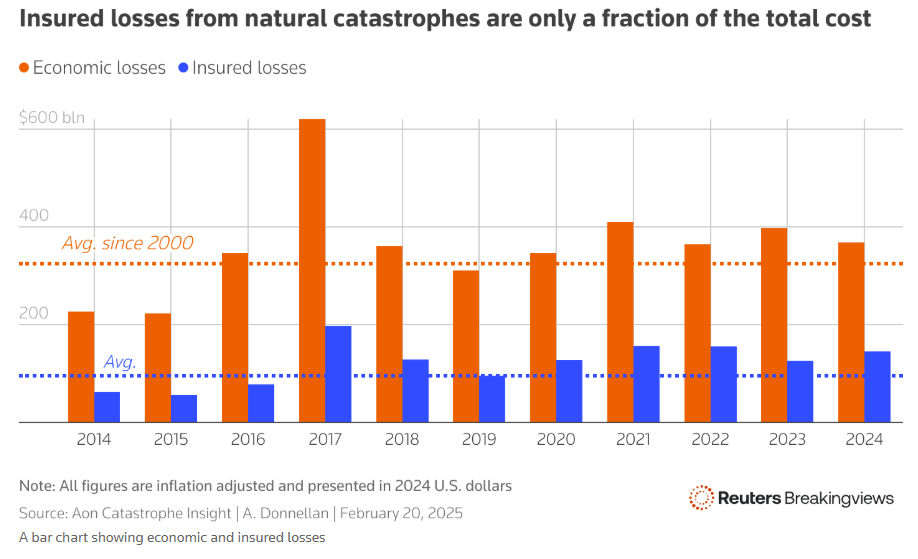

What insurers care about is what they have to pay out on. What you should care about is all of it.

When it comes to large-scale projects, these assets must be insured. Capital won’t touch BESS, offshore wind or solar farms otherwise. Insurance is an enabler of the energy transition. On the flip side, activists know that if insurers refuse to underwrite coal or oil, those projects will stall. This is why campaigners have begun to target the underwriting desks alongside the frackers and drillers.

The power of data

Insurers also sit on mountains of data. Historical claims, catastrophe models, satellite feeds, real-time weather analytics. There are entire teams of actuaries wading through this quagmire, turning the chaos into useable information. When insurers say a region is too risky, it’s not ideology, it’s math.

Fundamentally, insurers care about solvency, and because of that their data is brutally honest. If underwriting coal looks like a bad bet, they’ll move their money. If one region is causing a significant amount of claims, more than the premiums can cover, they’ll pull out. It’s really quite simple. That’s why, when insurers vanish, we should all take heed. It’s a massive warning sign that a certain place is no longer safe to live, work, or build. Conversely, when they hike premiums on coal but offer better terms for offshore wind, it’s a signal of where capital should flow.

So next time you think of insurers as boring paper-pushers, remember: they hold the data that decides which parts of the world are livable, which industries get built, and who’s left holding the bag when the water comes in.