Mediocre Metrics 3: Energy returned on (energy) invested (EROI)

Why a rule of thumb doesn't say much about overall technical feasibility or economics

In this edition of mediocre metrics, we’ll look at a metric that is absolutely useless outside of theoretical physics and deep tech VC yolo bros

Definition:

Energy return on (energy) invested (EROI) compares the energy gained from an activity vs the energy put into it. An EROI > 1 means more energy is delivered than used.

Useful:

If a technology is technically feasible and has an EROI >1 (basically the current goal for fusion).

As a barrier to see if a technology is roughly financially viable in conjunction with other common complications.

To discuss biofuels, which are subsidy-fueled farmer-votes harvesting machines.

Not useful:

Hard to accurately calculate for complex systems that include mining, transport, conversion between heat and work, etc.

For most established technologies, it’s completely irrelevant. A business case takes this into account. If EROI is too low, it’s not getting built in the first place. So why discuss this topic at all if it’s just one of many inputs for an economic calculation? If the overall calculation works out, the inputs don’t really matter.

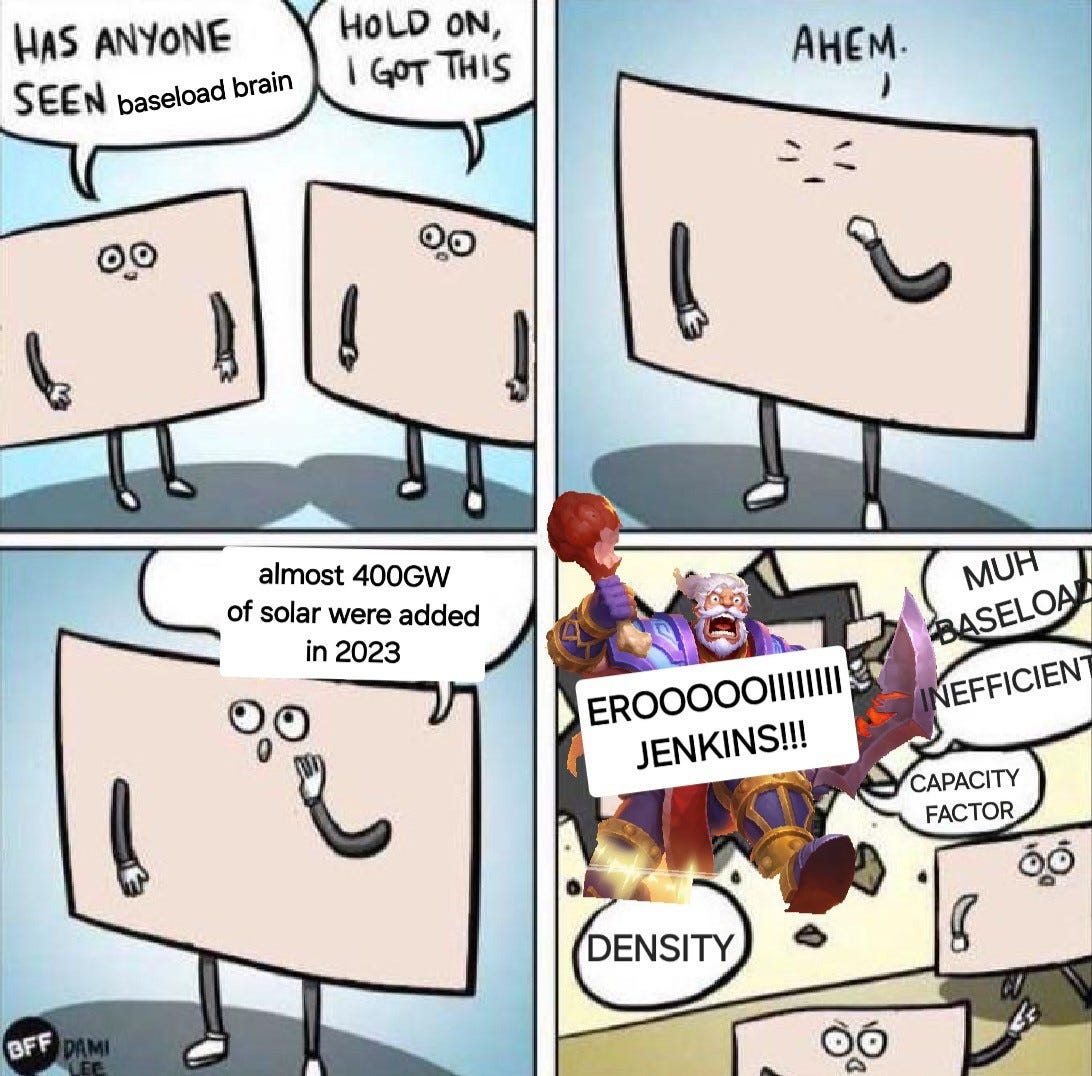

Misuse:

Commonly used by anti-renewables twitter pundits to show that nuclear and fossil fuels are superior with highly misleading and/or outdated data.

Classically combined with other claims like energy density being too low, land-use too high or any other such metric that doesn’t pose a real hurdle to the renewable investment case because it just does not matter.

Clearing the hurdle

Most energy technologies deployed at scale comfortably clear a hurdle of 10x EROI and only biofuels really show poor results.

Source: Energy Return on Investment of Major Energy Carriers: Review and Harmonization 1

No one outside of the pits of mis- and disinformation on Twitter or Reddit uses EROI.

If EROI were an issue, it would be discussed or tracked as a KPI. Instead, we track something like capital expenditure per MW / MWh or LCOE. Ultimately, return on investment (actual ROI, or even better IRR) is the final characteristic that brings it all together. Given we have fully unsubsidised wind and solar investments, clearly EROI is a non-issue. ROI > EROI

See figure 5 in https://www.mdpi.com/2071-1050/14/12/7098