Mediocre Metrics 2: Levelised Cost of Electricity (LCOE)

Why the cost of one element says nothing about its value nor the cost of the whole system

In this part of mediocre metrics, we’ll look at one of the most contentious metrics in the energy transition debate: LCOE. Revamping a whole energy infrastructure system requires vast amounts of capital but as renewables are rolling down the experience curve, costs remain in free fall. What metric should be used to track such costs and what should you be aware of when using such metrics? Read on!

Definition

Levelised cost of electricity gives you a life time assumption for a powerplant’s total cost of development, capital expenditure (what it costs to get started), operational expenditure (what it costs to run) and capital costs divided by the total amount of energy produced. That’s it.

It’s useful

to compare the production costs of zero marginal cost plants, where an additional unit of energy is produced an almost no extra cost, like renewables and nuclear to an extent.

to compare production costs within a single technology keeping fuel assumptions the same.

It’s not useful

to compare anything but direct generation cost excluding transmission.

to compare the value of power produced (a plant can be cheap but be in the middle of nowhere, with no existing market and creating no value).

to compare across technologies e.g., renewables vs plants that have significant fuel costs as you need to compare free wind, sun or rain to variable gas and carbon prices.

if the used fuel has a specific supply/demand dynamic (e.g., coal, gas, uranium, biofuels; not: wind, sun) so you need a cost assumption too. Hence, the LCOE of such power plants is a function of often regional and highly volatile commodity prices.

for flexible power plants that are not designed to provide the cheapest commodity energy but to act more as a service. e.g., bottled water is expensive vs tap water, but if you were in the middle of the desert you would pay a million euros for whatever was available.

It’s misused

to indicate that the LCOE could be extrapolated for a whole system which generally doesn’t work. The system will be a blend of LCOEs of different technologies one making up for the shortcoming of another.

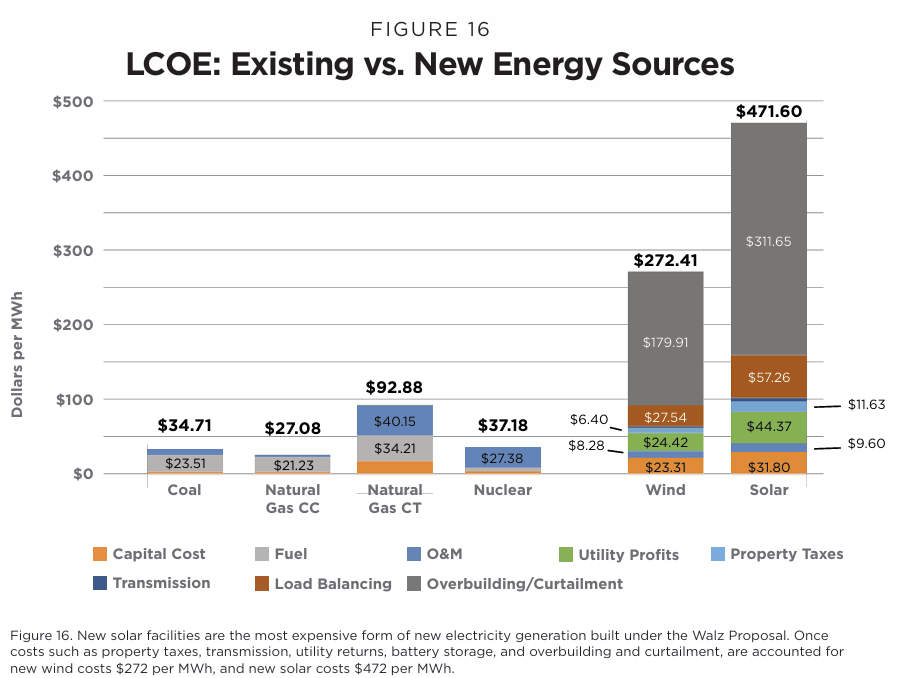

to obscure the fact that wind and solar have the lowest LCOEs in most regions of the world. Often you see charts baking in assumptions like back up storage, additional grid, their hurt feelings, etc. Result? Gazillion batteries means renewables big bad!

These points obviously ignore a diversified portfolio approach - one tech is another’s backup

Added baggage

LCOE says nothing more than cost per unit energy, but you can arbitrarily inflate that cost by making random assumptions, especially on overbuild/storage requirements to serve a whole system with one technology. Here’s a sham report from a think tank guy with the twitter handle “@TheFrackingGuy”.1

Studying data across technologies can become quite complex, so unless you’re tracking comparable technology over time, you need to understand the underlying assumptions.

Lazard’s annual report is often taken as a reputable source, but also check IRENA or BNEF – in all renewables are winning bigly!

Wind and solar beat any other technology on LCOE but also dispatchable ones on marginal cost meaning it’s cheaper to build a new renewable asset than operate an existing dispatchable plant. To understand LCOE for fossil and storage backed renewables, you really need to dig into the assumptions.2

Source: Levelized Cost of Energy+ | Lazard3

Renewables are bad and nuclear and fossils very good according to this joke of an article

Read into fuel cost and battery assumptions in Lazard’s report and understand the limitations of such analysis across technologies

See slide 2 in the 2023 report but check the latest report here https://www.lazard.com/research-insights/levelized-cost-of-energyplus/

Interesting point, it's nice to see renewables fan take a step back and criticize the metric they use the most.

The only thing that annoys me here is : why aren't you developing more your note on the limitations of LCOE applied to the different energies ? In your note you are starting to touch to one of the big problems with measuring the real cost of renewable production aaaand... Right as we get to it you brutally interrupt your note and conclude "Renewables are winning big time".

I’m increasingly feeling that LOCE has little value in currency terms and particularly in volatile markets. We need to move away from the ‘knowing the cost of everything but the value of nothing’-basis we currently have and build a metric that factors in the really important stuff like level of damage to the environment, biosphere and atmosphere, the ability to repair that damage, reuse and recycling of materials and so forth.