Never-ending Nuclear Nuisance

The ongoing debate on nuclear's role in the decarbonisation of energy until 2050 from the perspective of energy investors

Is nuclear low carbon - yes

Is nuclear safe - yes

France gud, Germany bad - yes

Should we build new nuclear reactors - largely no

Here we want to review what qualities are inherent to nuclear and what they mean for their economics and climate impact. Disclaimer: This is not an academic paper, but a blog and will remain high level. We’d love to keep the post somewhat alive so criticism is highly appreciated so we can include feedback where appropriate!

Technology & Regulation

Let’s revisit some high-level technological points that are important to understand for later discussions (we’re only scraping the surface here really).

Nuclear power is highly complex - it requires ultra specialised everything, from material to software and skilled labour. It’s taking boiling steam to the ultimate, finely balancing the speed to radioactive decay to generate heat, boiling water and driving a turbine. The engineering of a coal power plant doesn’t even come close.

Nuclear needs to be super safe and regulated - to ensure the high severity of a nuclear accident is paired with an ultra low likelihood, regulators mandate super stringent design and operation of nuclear facilities. With safety top of mind, reactors are surrounded by extra equipment to minimise risk (e.g., Hinkley Point C has 4 x redundancy of its safety system built in, one operating, one in maintenance, 2 on standby). During operation, small issues can cause long shutdowns as maintenance is lengthy and procedures highly controlled.

Nuclear is generally centralised and big - plants are largely designed as bespoke plants and not really modular which hinders manufacturing advances. Small modular reactors have for the most part been a failure.

Nuclear is moderately flexible - especially the French fleet integrated into a highly renewable European system have shown to ramp down a lot (12 GW or 20% of capacity in a day) but it’s technical ability generally has a floor and introduces unfavourable stress to materials (a great read is the recent Kpler report). Generally, they can ramp a lot but are not useful as peakers, due to slow cold start, high minimum power and, mainly, economics - more on this later.

Slow and steady

A small number of a big number is still a big number - while slow, a massive nuclear power plant will ramp a lot of capacity

Source: a), Power plants: cold starts and ramp rates? b) Quo Vadis, Grid Stability?

Nuclear needs cooling - the requirement for ample cooling water or refrigeration means inland reactors are more exposed to drought and high temperatures.

Nuclear needs to store waste - a fleet of breeder reactors doesn’t exist yet to recycle it, neither does proper storage at scale. While not the greatest issue, no working solution has been provided yet.

Nuclear needs decommissioning - like any infrastructure, proper dismantling is required. This is a bit more difficult than plugging a well or recycling concrete from a road.

Bridge to business case

Let’s analyse the business case using a simple schematic / framework to derive value (in the financial sense)

The many branches in which value roots

A value driver tree is a overly simplified framework to understand how a business creates value

Source: I made it up

1 | Starting up: Construction and capital expense

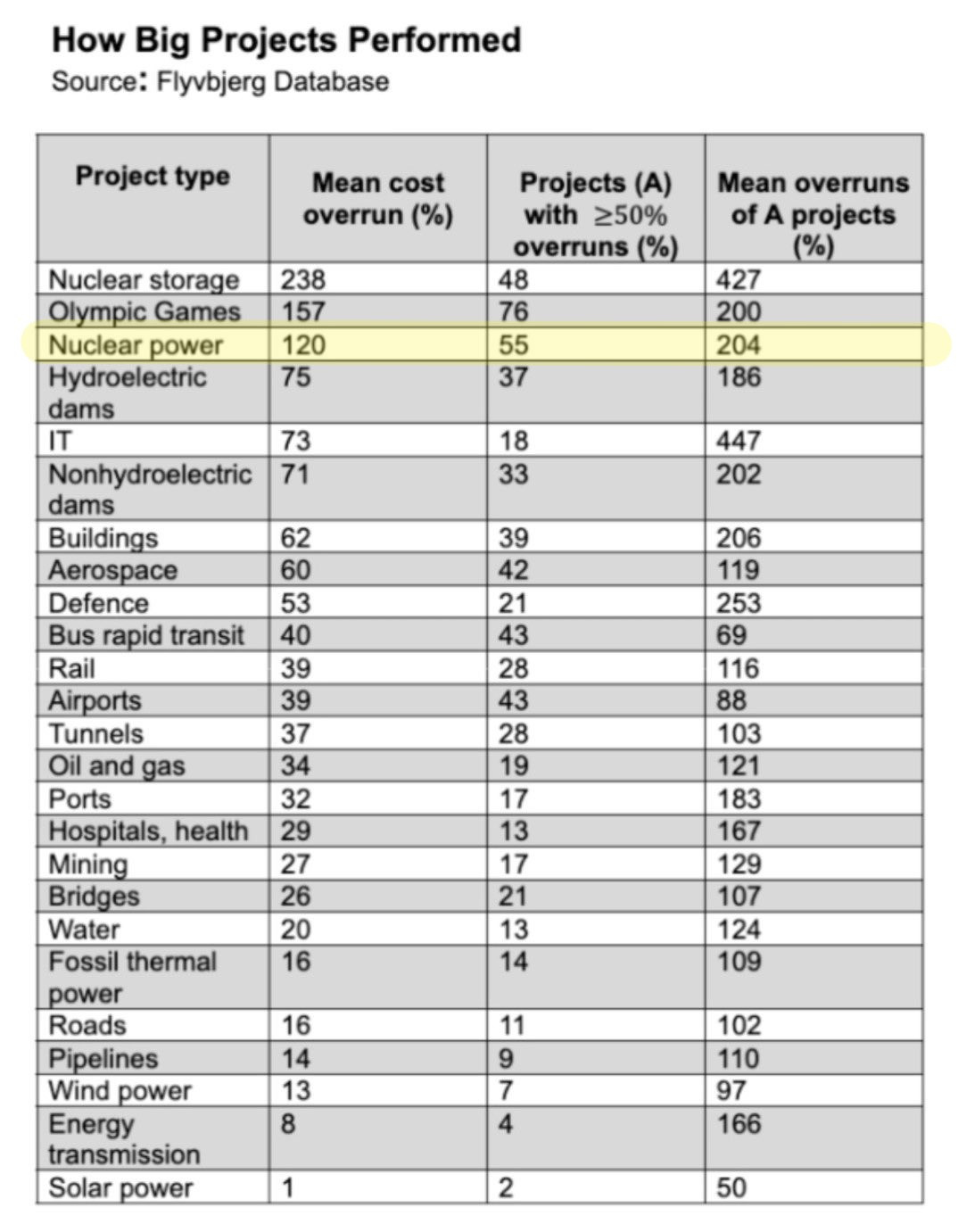

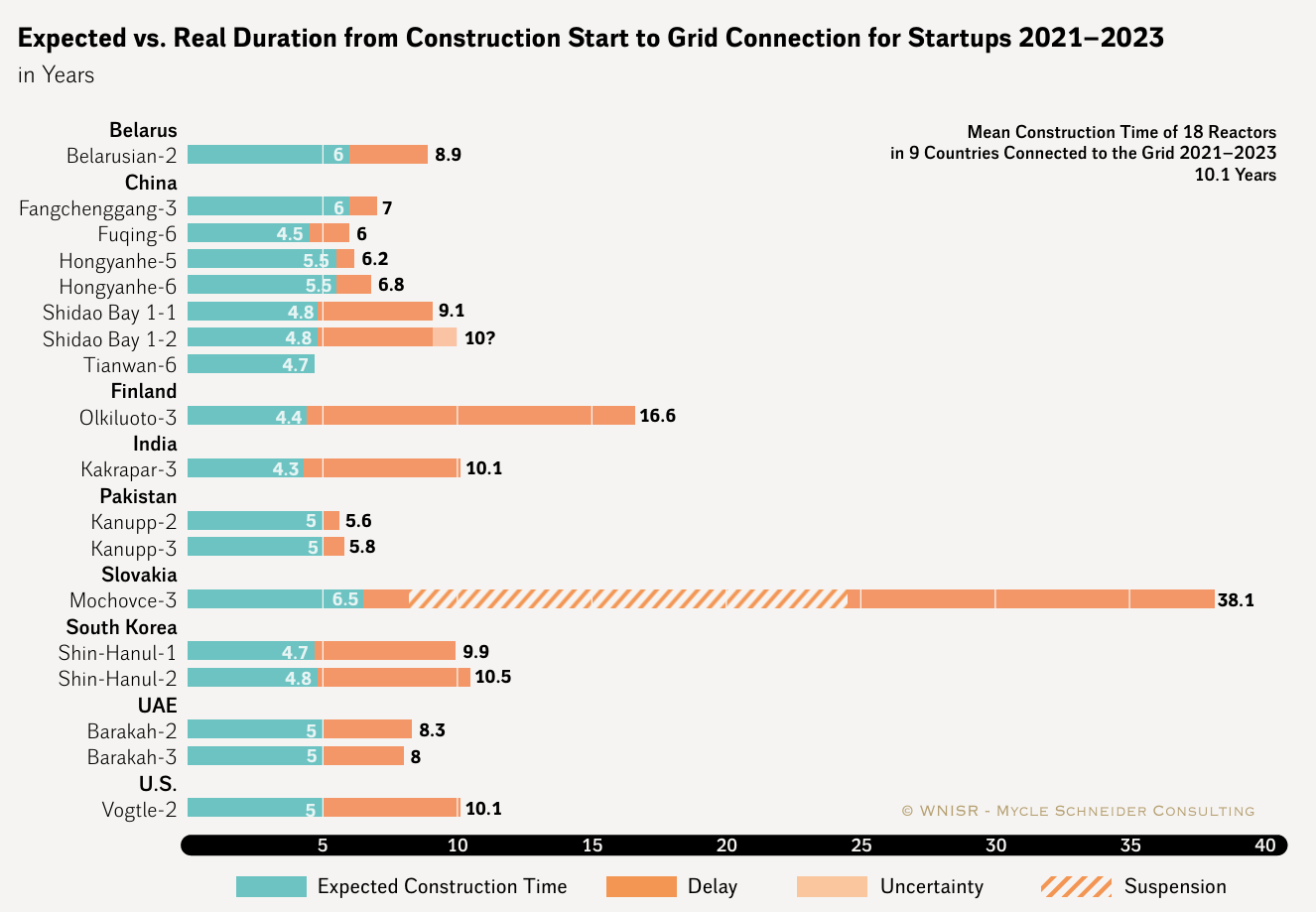

The elephant in the room is the mind boggling cost of nuclear power plants as they have been subject to negative experience curves on the back of increased regulation and low utilisation of an aging work force

En attend nucléaire

Nuclear power costs a lot more and takes a lot longer than expected.

Simply looking at recent global construction times confirms this…

… and “Western” planning + construction times are completely out of hand.

Source: a) Flyvbjerg: How Big things Get Done; b) The World Nuclear Industry Status Report 2024; c) Twitter

2 | Shutting down: End of life provision

Decommissioning is a cost easily ignored as it happens decades down the line from the investment decision. This can lead to significant harm to society. In many cases maliciously such as in unplugged gas wells leaking methane, sometimes due to poor planning and omission of a reserve account to pay for it later. Sometimes, because we have no clue of the order of magnitude of effort involved.

In the UK, an early mover and hence has waste sites that are difficult to control and initially without proper funding mechanism. The government will have to pay up to the tune of GBP 130bn - largely for Sellafield and final geological storage at ~GBP 100bn and around another GBP 1.2bn per reactor. In Switzerland, operators pay into an investment fund to meet costs estimated to be around CHF 24bn fore 2865MW plus intermediate storage.

New plants will have to properly budget for such decommissioning.

3 | Risk to revenue and competition with renewables

As we have previously discussed, renewables are competing with nuclear for the same demand and are reducing the residual baseload. Overall, a renewables dominant portfolio will meet a majority of demand at the lowest cost. The remaining demand will go into competition with fuels (be it hydrogen or CCS), long duration storage, but even demand reduction.

This leaves little space left for nuclear power to make money, further amplifying the riskiness of the business case.

4 | Insurance cost

There’s a reason r/uninsurable chose that name as it puts the finger in the wound of nuclear energy’s most gaping wound - insurers cannot cover it.

Risk = Probability x Severity

While the probability of a significant incident happening in a modern reactor is extremely low, the potential loss is enormous. The premia are huge to cover that, making the few insurers that are active some of most profitable in the market - should anything happen, the gov would have to step in anyway.

The US famously has a unique setup where the Price-Anderson Act provides a framework for nuclear liability requiring operators to purchase a certain level of insurance but limits the liability.

Canada, France and the UK also have a nuclear insurance system where operators are required to maintain insurance coverage and the government provides additional coverage picking up the tab for anything else.

If you required operators to acquire insurance in the free market, it would probably be the end of it.

5 & 6 | Finance cost and return expectations

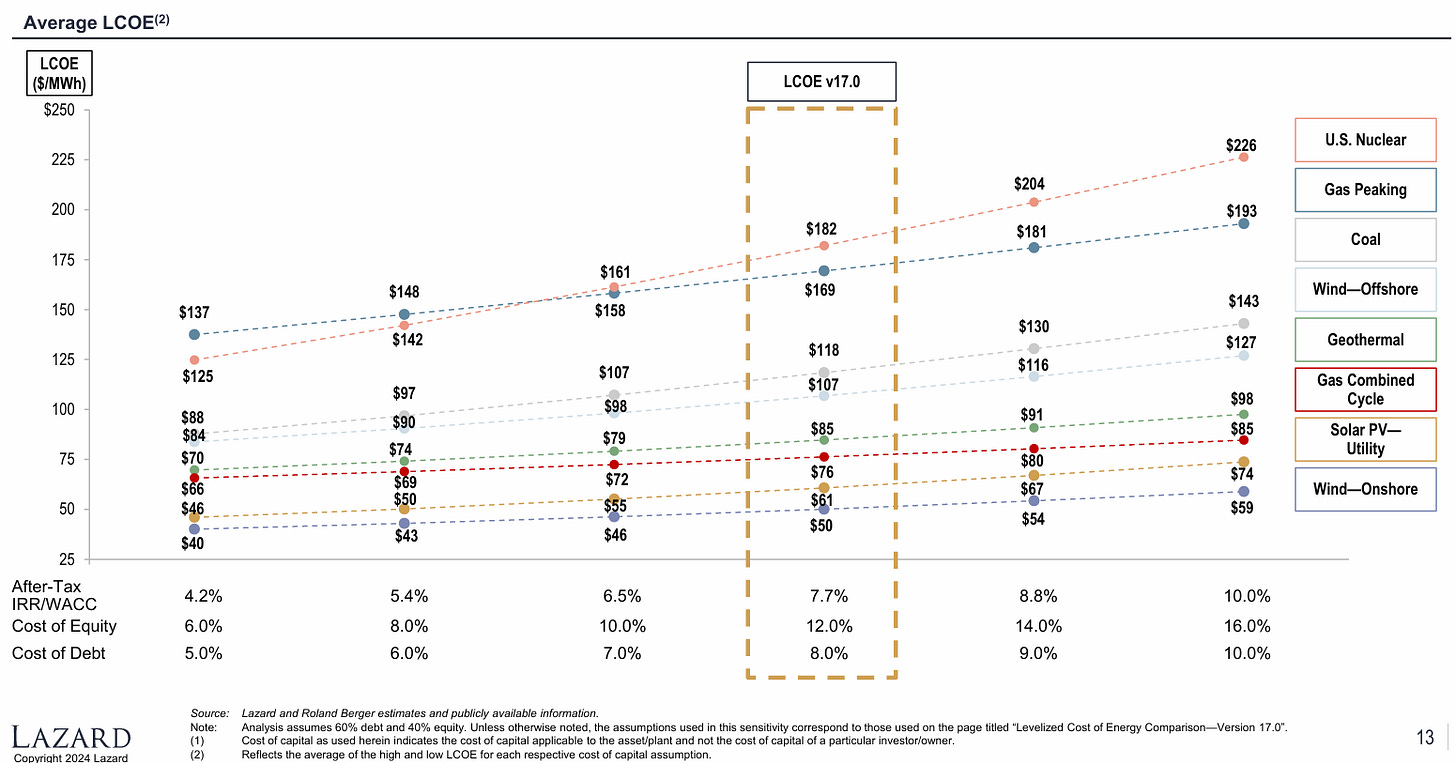

All these issues make nuclear power inherently risky. This is reflected in the return expectations of investors, be it explicitly in the cost of debt or implicitly in the cost of equity. Given the immense capital expenditure, nuclear (as for renewables) is very sensitive to the cost of capital.

Hinkley Point C required an inflation linked price sitting north of 150 EUR/MWh whereas average prices in NW Europe hover around 50-70 EUR/MWh. Still, EDF’s Chinese co-investor refuses to put more money in and now more money is to be raised.

Hence, Sizewell C is supposed to be funded via a Regulated Asset Base (RAB) model to guarantee the investors a return on their capital which allows them to earn profits already during construction and are unaffected by market prices.

Sensitive side

Rising rates or perceived riskiness greatly impact financing costs for nuclear power and hence its LCOE.

Source: Lazard LCOE v17

Bridge to climate impact

Slow to deploy vs renewables

Given timelines of even >20 years from planning to first power, we’d be in the mid 2040s. We need climate action now. The later decarbonisation happens, the higher our cumulative emissions and hence cumulative damage done.

In addition, the significant risk of delay would leave us probably short in many scenarios when a new nuclear fleet is delayed by many years. The shortfall would most likely be made up by delaying retirement of fossil fuel power plants.

Opportunity cost vs renewables

Apart from the timing aspect, our available resources are also limited. For every bit of currency we can spend, we hope to get the highest impact. With wind and solar having rolled down the experience curve already, batteries are coming right after to balance the new supply.

A portfolio of wind, solar and storage can be deployed practically everywhere, derisked and ready to go. More interconnection helps connecting areas with less correlated generation (e.g., east west to send solar energy through time zones)

More risky to deploy than renewables

Part of the risk is reflected in the cost but also in terms of planning, a potential 5 year delay of a 3GW nuclear power plant will leave the market short of that electricity. Some investors might deploy extra short term capacity speculating on high prices to capture, the gov might subsidise thermal capacity on standby just in case.

Big things are just not as plannable as many, many small things are.

Level playing field

Levelised cost of Electricity represents the price that needs to be paid per MWh to finance a project and requires several assumptions (which you should check). Generally a reasonable methodology to track the average cost of the technology in a simplified way.

Source: Lazard LCOE v17

Silver lining

Winter capacity will still be our biggest challenge and wind overbuild a large challenge given higher complexity than solar but also significant local opposition. Purely from a risk perspective it can make sense to aim to build one NPP that should be ready early/mid 2040s when renewables should converge towards >80% of demand.

Many nations will continue to build nuclear plants, either as they have somewhat of an industry built up such as France or Korea, but also to provide a skill base for military purposes such as arms and marine propulsion.

Outlook

Some countries will achieve some net additions to their nuclear base, such as Korea, China or the UAE. Most countries will add mostly renewables.

Gaining ground

Renewables are set to dominate the global generation mix in any case.

Source: BNEF World Energy Outlook 2024

Poor renewable resources, significant land constraints, medical and military use cases are all reasons supporting nuclear, especially if a legacy industry exists, plus deep pockets and political continuity are requirements. This isn’t the case for most countries.

Hence renewables will continue to take over - and we need to ensure this will happen even faster than before!

With all that the Biden administration, the DOE, NRC, etc have thrown at the industry and utilities to "incentivize" them to roll the dice with their companies and careers by building another AP-1000 (Loan guarantees, grants, tax-abatements, siting subsidies, and on, and on; on top of the existing subsidy regime like Price-Andersen, etc), they still want more! More, more, more and not a single contract to build in sight.

They literally had the nerve to tell Granholm at the opening of Vogtle that they "needed" more free money from the government, especially the Holy Grail of nuclear subsidies : govt picking up the tab for any and all construction cost overruns. HAHAHAA. That's why they can't build plants now! Because they've been incentivized by various Republican state legislatures through variations of CWIP laws to NEVER complete construction.

The way to make a fortune in nuclear is not to generate and sell nuclear power but to just never finish building the plants you started and keep rolling in all that sweet tax and rate-payer money. It is an elegant scam.

" don't get why underground safe storage for waste is considered as an issue. It's pretty much 0 impact and if our focus is to fight climate change"

Well, 0 impact is certainly not true as the waste will be trucked overland in thousands of shipments that will all converge on Nevada's roads alone.

What I don't get is why Nuke promoters don't consider something a problem if it's scientifically possible; "that's just politics" is the pat response. Well, political problems are still REAL problems too and this one has kept Yucca Mountain from being built and deployed for 40 years.

Stop saying waste is not a problem because it IS a problem with NOWHERE to store it yet; you are being intentionally deceptive. No solution is on the horizon or in consideration through the consent-based siting process AND with the Supreme Court essentially tossing out hundreds of years of precedent and the ability of an elected government to do the will of the people through agency regulation, NO deep geologic depository is being built any time soon.

The other thing I don't understand is, when nearly every single politician in Nevada has been vehemently opposed to Yucca and an overwhelming majority of Nevada citizens have consistently opposed Yucca over decades, how was it Harry Reid going rogue to put an end to the political project? He was literally doing the will of his constituents. Yucca was selected before ANY of the science was considered, because of POLITICS.